All Categories

Featured

Table of Contents

Section 691(c)( 1) provides that a person who includes a quantity of IRD in gross earnings under 691(a) is enabled as a reduction, for the very same taxed year, a portion of the estate tax paid because the inclusion of that IRD in the decedent's gross estate. Generally, the amount of the deduction is determined using inheritance tax values, and is the quantity that births the exact same proportion to the estate tax attributable to the internet value of all IRD items included in the decedent's gross estate as the worth of the IRD consisted of because person's gross earnings for that taxed year bears to the worth of all IRD items included in the decedent's gross estate.

Section 1014(c) gives that 1014 does not apply to property that constitutes a right to get a thing of IRD under 691. Rev. Rul. 79-335, 1979-2 C.B. 292, addresses a circumstance in which the owner-annuitant acquisitions a deferred variable annuity contract that gives that if the proprietor passes away before the annuity starting day, the named recipient may choose to receive today accumulated value of the agreement either in the kind of an annuity or a lump-sum repayment.

Rul. 79-335 wraps up that, for functions of 1014, the agreement is an annuity described in 72 (as after that effectively), and as a result receives no basis adjustment by reason of the proprietor's fatality due to the fact that it is regulated by the annuity exemption of 1014(b)( 9 )(A). If the recipient elects a lump-sum payment, the excess of the quantity obtained over the quantity of factor to consider paid by the decedent is includable in the recipient's gross earnings.

Rul. Had the owner-annuitant gave up the agreement and got the quantities in excess of the owner-annuitant's financial investment in the contract, those amounts would certainly have been revenue to the owner-annuitant under 72(e).

Taxation of inherited Annuity Cash Value

Furthermore, in the present situation, had A gave up the agreement and received the quantities moot, those quantities would certainly have been income to A under 72(e) to the level they went beyond A's financial investment in the agreement. Appropriately, amounts that B obtains that surpass A's investment in the contract are IRD under 691(a).

, those quantities are includible in B's gross income and B does not receive a basis modification in the contract. B will be entitled to a reduction under 691(c) if estate tax was due by reason of A's death.

The holding of Rev. Rul. 70-143 (which was withdrawed by Rev. Rul. 79-335) will continue to obtain deferred annuity contracts purchased before October 21, 1979, including any kind of payments used to those agreements pursuant to a binding commitment became part of prior to that day - Immediate annuities. PREPARING details The principal writer of this earnings judgment is Bradford R

Q. How are annuities exhausted as an inheritance? Exists a distinction if I inherit it straight or if it goes to a count on for which I'm the beneficiary?-- Planning aheadA. This is a wonderful question, however it's the kind you ought to take to an estate preparation lawyer that understands the information of your situation.

What is the relationship between the deceased owner of the annuity and you, the beneficiary? What kind of annuity is this? Are you asking about income, estate or estate tax? After that we have your curveball concern regarding whether the result is any kind of different if the inheritance is through a trust fund or outright.

We'll presume the annuity is a non-qualified annuity, which indicates it's not component of an Individual retirement account or other certified retirement plan. Botwinick said this annuity would certainly be included to the taxable estate for New Jacket and federal estate tax objectives at its day of death value.

Do you pay taxes on inherited Annuity Income

person spouse surpasses $2 million. This is referred to as the exemption.Any quantity passing to an U.S. resident partner will certainly be totally excluded from New Jersey inheritance tax, and if the proprietor of the annuity lives to the end of 2017, then there will certainly be no New Jacket estate tax obligation on any kind of amount because the estate tax is arranged for abolition starting on Jan. Then there are federal inheritance tax.

The existing exemption is $5.49 million, and Botwinick said this tax is possibly not vanishing in 2018 unless there is some significant tax obligation reform in a genuine hurry. Fresh Jacket, federal estate tax law supplies a full exception to quantities passing to making it through united state Following, New Jacket's inheritance tax.Though the New Jacket inheritance tax is scheduled

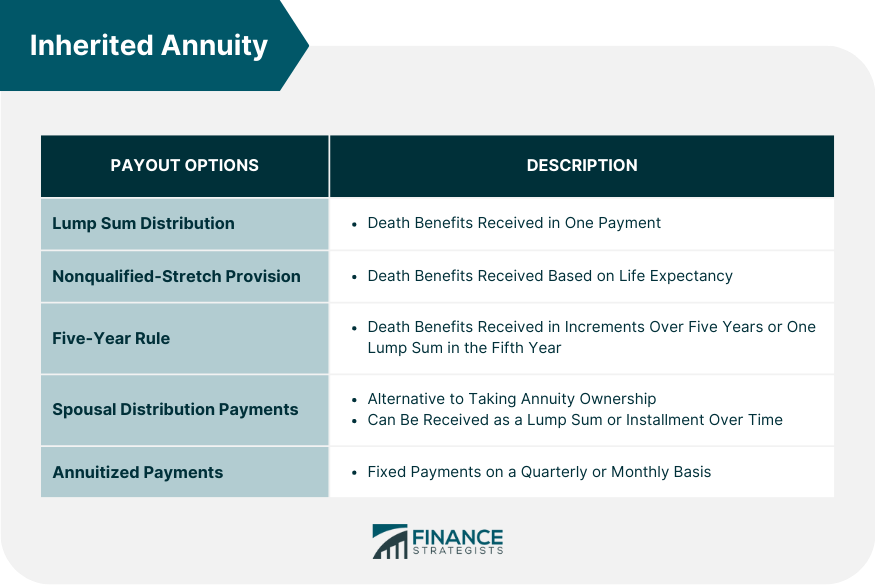

to be rescinded in 2018, there is noabolition set up for the New Jersey inheritance tax, Botwinick said. There is no government estate tax. The state tax obligation is on transfers to every person aside from a specific class of people, he said. These consist of partners, youngsters, grandchildren, moms and dad and step-children." The New Jacket estate tax uses to annuities equally as it applies to other assets,"he stated."Though life insurance policy payable to a particular recipient is excluded from New Jersey's inheritance tax obligation, the exemption does not relate to annuities. "Now, income taxes.Again, we're presuming this annuity is a non-qualified annuity." In a nutshell, the profits are exhausted as they are paid out. A part of the payout will be dealt with as a nontaxable return of financial investment, and the incomes will be strained as normal income."Unlike inheriting other assets, Botwinick said, there is no stepped-up basis for acquired annuities. However, if inheritance tax are paid as an outcome of the incorporation of the annuity in the taxable estate, the beneficiary may be entitled to a reduction for acquired revenue in regard of a decedent, he stated. Annuity payments contain a return of principalthe cash the annuitant pays into the contractand rate of interestgained inside the agreement. The passion section is exhausted as ordinary revenue, while the primary quantity is not exhausted. For annuities paying out over an extra extensive duration or life span, the major portion is smaller sized, resulting in less taxes on the month-to-month payments. For a couple, the annuity contract might be structured as joint and survivor so that, if one partner passes away , the survivor will certainly continue to obtain guaranteed repayments and enjoy the very same tax obligation deferral. If a recipient is called, such as the pair's youngsters, they end up being the recipient of an acquired annuity. Recipients have multiple alternatives to think about when selecting just how to get cash from an inherited annuity.

Table of Contents

Latest Posts

Understanding Variable Annuities Vs Fixed Annuities Key Insights on Tax Benefits Of Fixed Vs Variable Annuities What Is Immediate Fixed Annuity Vs Variable Annuity? Features of Smart Investment Choice

Understanding Fixed Indexed Annuity Vs Market-variable Annuity A Closer Look at Fixed Income Annuity Vs Variable Annuity Defining Variable Annuities Vs Fixed Annuities Benefits of Pros And Cons Of Fix

Highlighting Pros And Cons Of Fixed Annuity And Variable Annuity Everything You Need to Know About Financial Strategies What Is the Best Retirement Option? Pros and Cons of Fixed Index Annuity Vs Vari

More

Latest Posts